ADP W2 Former Employee – ADP W2 forms are vital documents for former employees as they contain crucial tax information necessary for filing taxes accurately. Understanding how to access and interpret your ADP W2 can prevent costly mistakes and ensure compliance with IRS regulations. This informative guide will walk you through the process of obtaining your ADP W2 as a former employee, highlighting key points to pay attention to and how to use this document effectively for tax purposes.

Key Takeaways:

- Understanding W2 Forms: W2 forms are important tax documents that former employees receive from their former employers, detailing their earnings and tax withholdings for the year.

- Importance of Accuracy: Ensuring the accuracy of the information on your W2 form is crucial for filing your taxes correctly and avoiding potential penalties from the IRS.

- Deadline for Issuance: Employers, including ADP, are required to provide W2 forms to former employees by January 31st of each year, allowing individuals to prepare and file their taxes in a timely manner.

- Accessing W2 Forms: Former employees who have not received their W2 forms by the deadline should contact their former employer or HR department, such as ADP, to request a copy or inquire about its status.

- Utilizing W2 Information: Once you receive your W2 form, carefully review the details and use the information provided to accurately complete your tax return, ensuring compliance with IRS regulations.

Understanding W2 Forms

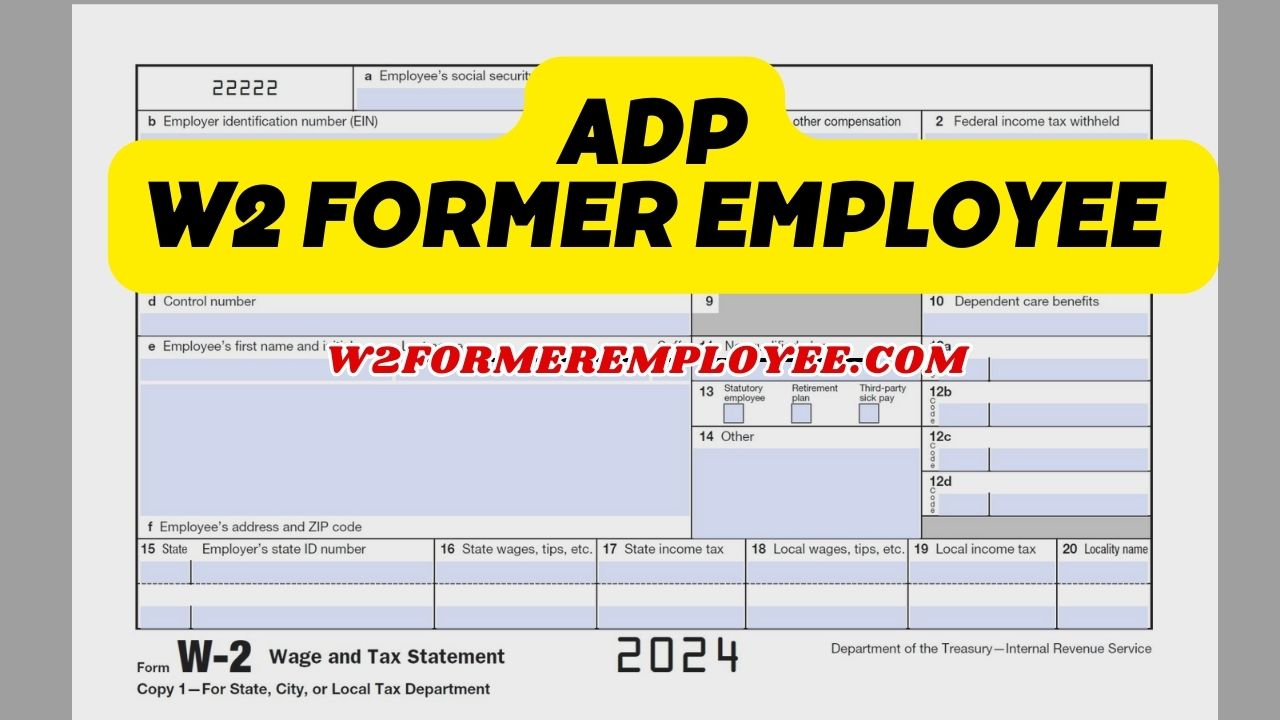

Explanation of W2 Tax Form

Some individuals might find tax forms confusing, but the W2 form is a crucial document that provides detailed information about an employee’s income and taxes withheld during the year.

Components of the W2 Form

For a former employee, the W2 form includes important details such as the employee’s wages, tips, other compensation, as well as the taxes withheld by the employer.

It is crucial to review your W2 form for accuracy, as any mistakes could lead to potential issues with the IRS. Make sure your personal information, earnings, and withholdings are correctly reported on the form.

Accessing W2 Forms as a Former Employee

Steps for Former Employees to Retrieve W2s

Former employees seeking their W2 forms can access them through the ADP portal. Start by visiting the ADP website and click on the “Forgot your ID/Password?” link. Follow the prompts to retrieve your login information. Once logged in, navigate to the “Pay & Taxes” section and select “Annual Statements.” From there, you can download and print your W2 form for tax purposes.

Troubleshooting Common Issues

The process of accessing W2 forms may sometimes encounter obstacles. One common issue is forgetting login credentials or encountering errors in the system. If you are unable to retrieve your information online, contacting the HR or payroll department of your former employer is crucial. They can assist in providing the necessary documents or guiding you through the steps to access your W2 forms successfully.

For a seamless experience in obtaining your W2 forms, it is crucial to proactively address any issues that may arise promptly. Keeping track of login details and reaching out to the appropriate channels for assistance are key steps in ensuring a smooth process.

Legal and Compliance Considerations

Employer Obligations for W2 Distribution

Your former employer has specific obligations when it comes to distributing your ADP W2 Former Employee. An employer is required by law to provide your W2 form by January 31st of the following year. This form is crucial for filing your taxes accurately and on time. If you have not received your ADP W2 Former Employee by this date, it is necessary to contact your employer promptly to ensure compliance with the IRS regulations.

Employee Rights and Tax Filing Deadlines

Any former employee has rights when it comes to receiving accurate tax information and meeting filing deadlines. Employees must ensure that the information on their W2 form is correct before filing their taxes. This includes verifying personal information, wages earned, and taxes withheld. Meeting tax filing deadlines is crucial to avoid penalties and fines from the IRS. Employees should be aware of the deadline, typically April 15th, to file their taxes in a timely manner.

Plus, it is necessary for employees to keep copies of their W2 forms and tax filings for a minimum of three years in case of any audits or discrepancies. Timely communication with employers and thorough review of tax documents are key to staying compliant with tax regulations.

To wrap up

On the whole, understanding ADP W2 Former Employee is crucial for ensuring accuracy in tax filings and financial planning. By familiarizing yourself with the information contained in the form and knowing how to access it, you can stay informed about your earnings, deductions, and employment details. This knowledge can empower you to address any discrepancies or issues that may arise, ultimately helping you navigate the tax season with confidence and ease. Remember to keep your ADP W2 Former Employee in a secure place and refer back to it as needed to support your financial well-being.

FAQ

1. What is an ADP W2 Former Employee?

An ADP W2 form is a tax form that former employees receive from their employer (ADP in this case) showing the total amount of wages earned and taxes withheld during the previous year.

2. How can I access my ADP W2 form as a former employee?

Former employees can access their ADP W2 Former Employee through the ADP portal or by contacting ADP directly if they no longer have access to the portal.

3. When can I expect to receive my ADP W2 Former Employee?

ADP W2 forms are typically distributed to former employees by January 31st of each year for the previous tax year.

4. What should I do if there is an error on my ADP W2 form as a former employee?

If you find an error on your ADP W2 form, you should contact ADP immediately to request a corrected form before filing your taxes.

5. Is the information on my ADP W2 form as a former employee confidential?

Yes, the information on your ADP W2 Former Employee is confidential and should only be shared with authorized individuals such as tax preparers or the IRS.

ADP Information

- Official Website: https://www.adp.com/

- ADP Portal Login: https://www.adp.com/logins/adp-portal.aspx

- ADP W2 Former Employee Phone Number: 844-227-5237.

- ADP Login Help: https://www.adp.com/contact-us/support-for-employees/adp-login-help.aspx